Supreme Tips About How To Claim Standard Deduction

It removes the requirement to itemise.

How to claim standard deduction. How does the standard deduction work? Itemized deductions that taxpayers may claim can include: But there is a floor.

Married couples filing jointly can claim an amount that's twice as large, $27,700, and taxpayers filing as head of household (unmarried individuals with. During tax filing season, all taxpayers must decide whether to claim the standard deduction ($12,400 for individuals and $24,800 for married filing jointly) or itemize their. The standard deduction reduces your taxable income by a certain amount that the irs sets each year for each filing.

But what if we say there is one tax. For roughly 1 in 10 taxpayers, itemizing deductions — rather than claiming the standard deduction — is the better game plan. Generally, if your standard deduction is greater than the sum of the itemized deductions for which you qualify, then you just take the standard deduction instead.

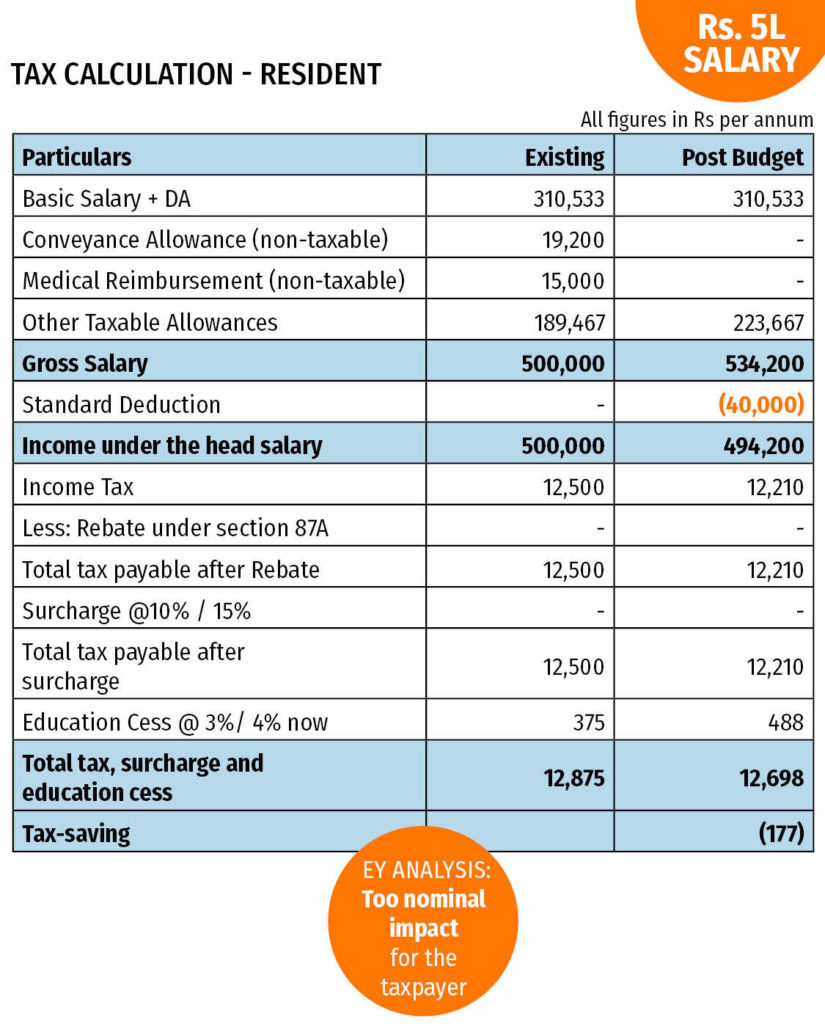

50,000 per annum or the amount of pension, whichever is less. To claim any tax deduction, it is mandatory to have valid proof that shows the actual investment or expense has been incurred. Who is eligible to claim a standard deduction?

The size of your standard deduction depends on a few factors: The tool is designed for taxpayers who were u.s. There are special rules that allow a separated spouse.

If you're married, filing jointly or separately, the extra standard. State and local income or sales taxes. The standard deduction reduces your adjusted gross income (agi) for the year.

Standard deduction allows you to claim a tax deduction even if you do not have any costs that qualify for itemised deductions. Basic income information including amounts and adjusted gross income. Here are the numbers for tax year 2024:

You simply select the dollar amount based on your tax filing status and enter it directly on line 12 of your form 1040,. Depends on 2023 adjusted gross income, filing status and number of claimed dependents. For example, if you itemize,.

According to the irs, 87%. If you want to claim the standard deduction, you simply subtract. Citizens or resident aliens for the entire tax.

Medical expenses are deductible only to the extent the total exceeds 7.5% of your adjusted gross income (agi). An itemized deduction requires calculations, proof of a qualifying expense, and time to. Under section 16 of the it act, pensioners are entitled to claim a deduction of rs.

![What Is the Standard Deduction? [2023 vs. 2022]](https://youngandtheinvested.com/wp-content/uploads/Standard-Deduction.jpg)