Great Info About How To Buy Short Term Treasury Bonds

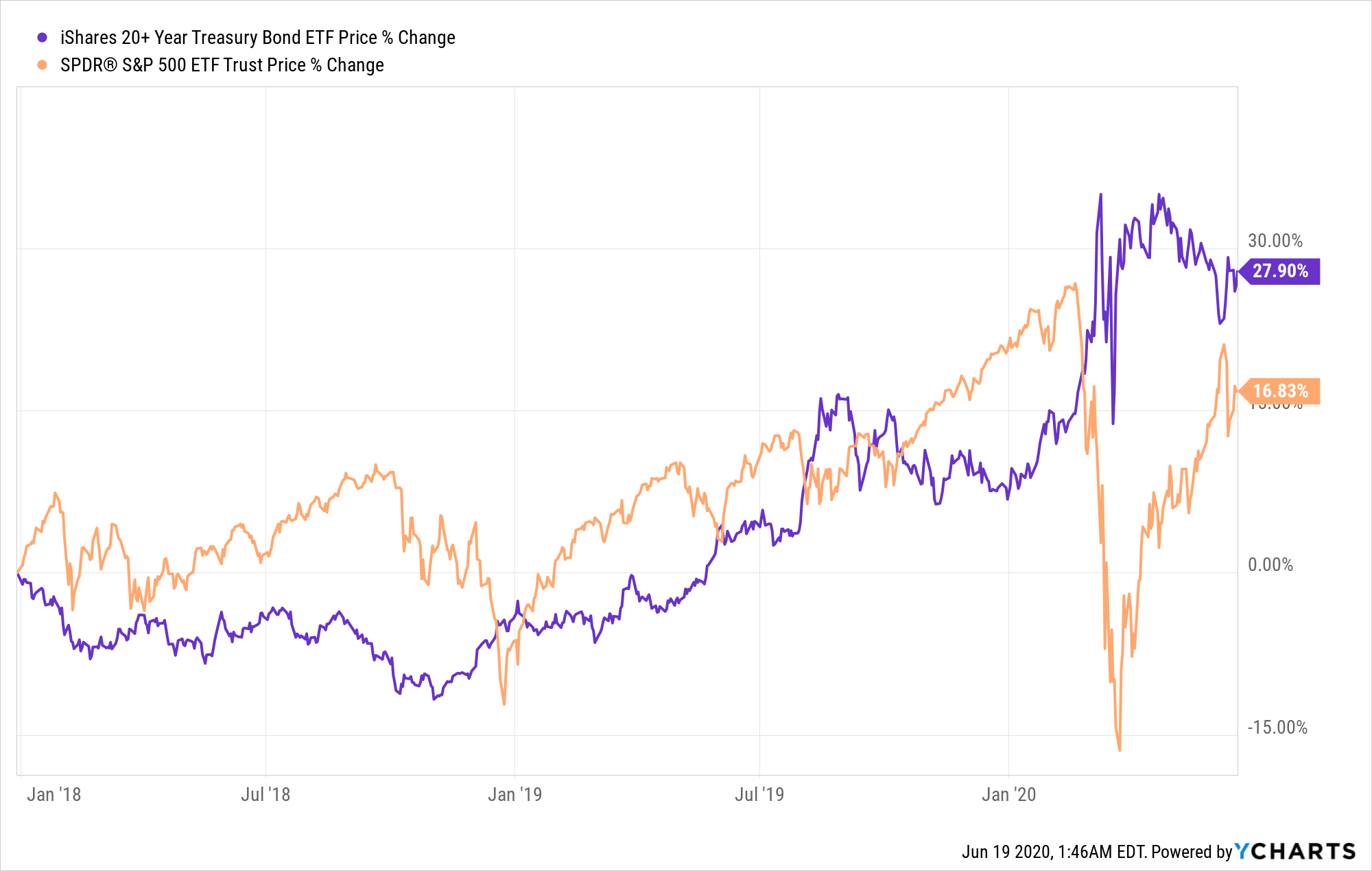

Treasury marketable securities marketable means that you can transfer the security to someone else and you can sell the security before it.

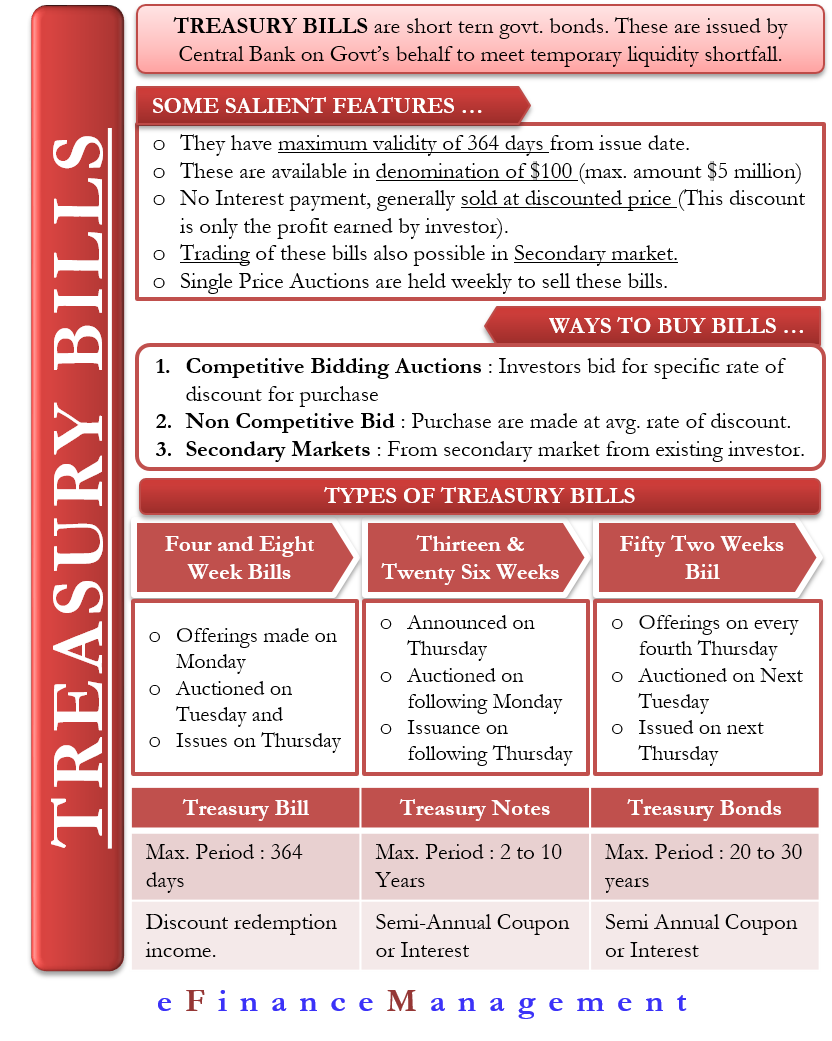

How to buy short term treasury bonds. What does marketable mean? Treasury bills can be bought directly from the government at treasurydirect.gov or through a brokerage account. More like this investing bonds.

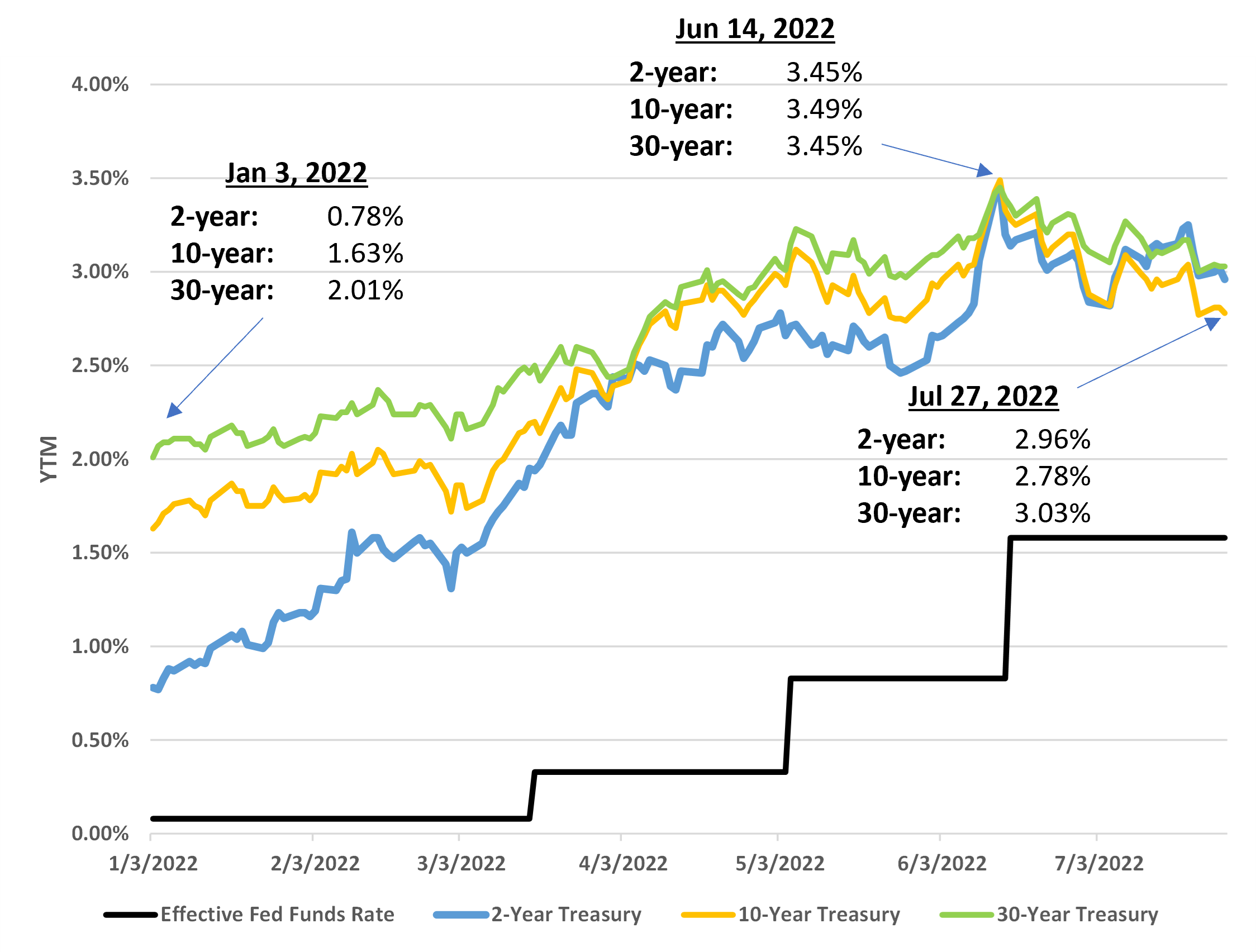

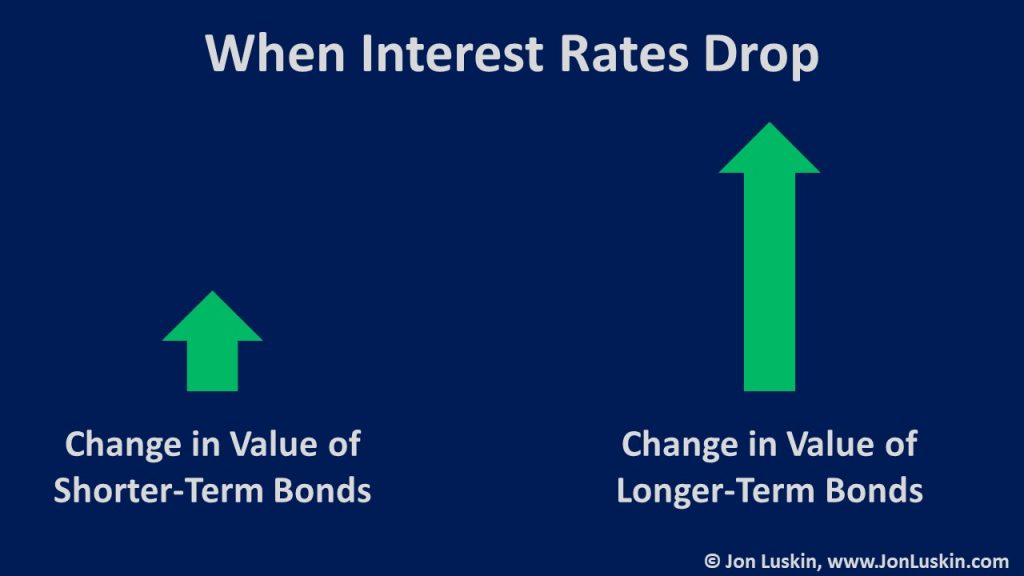

This makes sense, because investors. Treasury bonds pay interest on a semiannual basis, and when the bond matures, the owner is repaid with the face value of the bond. By purchasing individual bonds or by purchasing a fund.

From treasurydirect, the official u.s. Government with no broker at treasurydirect.gov. Or purchase them through a brokerage, retirement or bank account.

First, they can purchase treasurys directly from the u.s. The first step in the auction process is the announcement of upcoming auctions, generally four to five business days before. In 2022, there were 384 public auctions for $15 trillion in treasury debt securities.

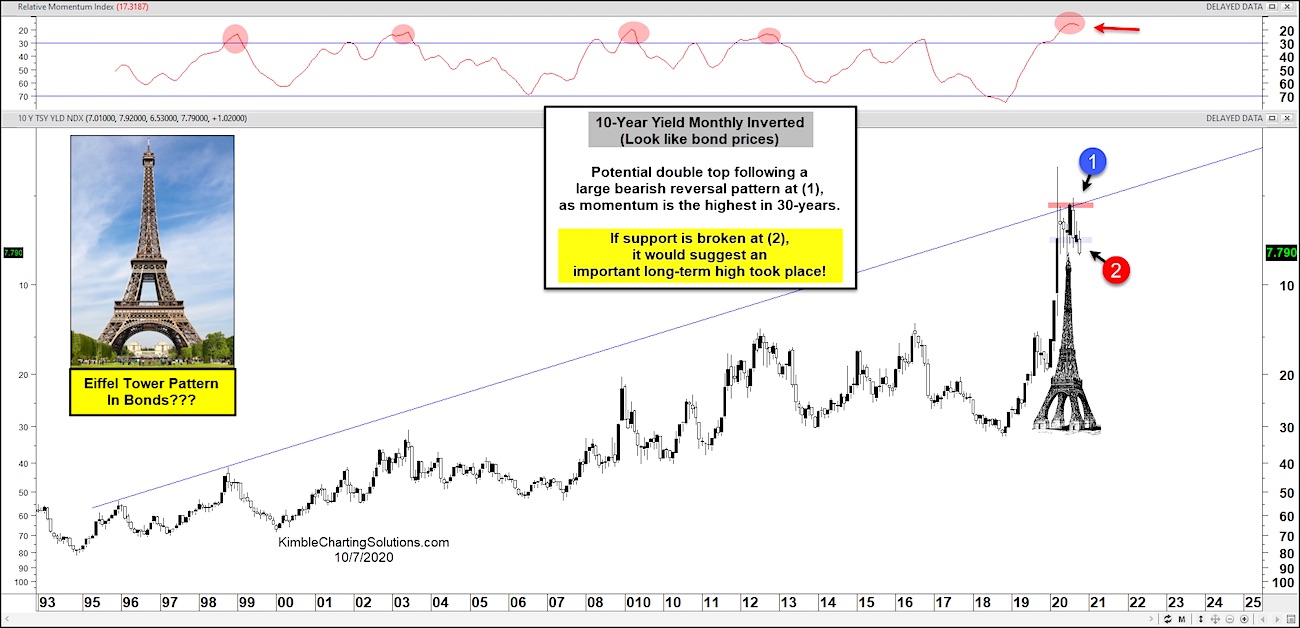

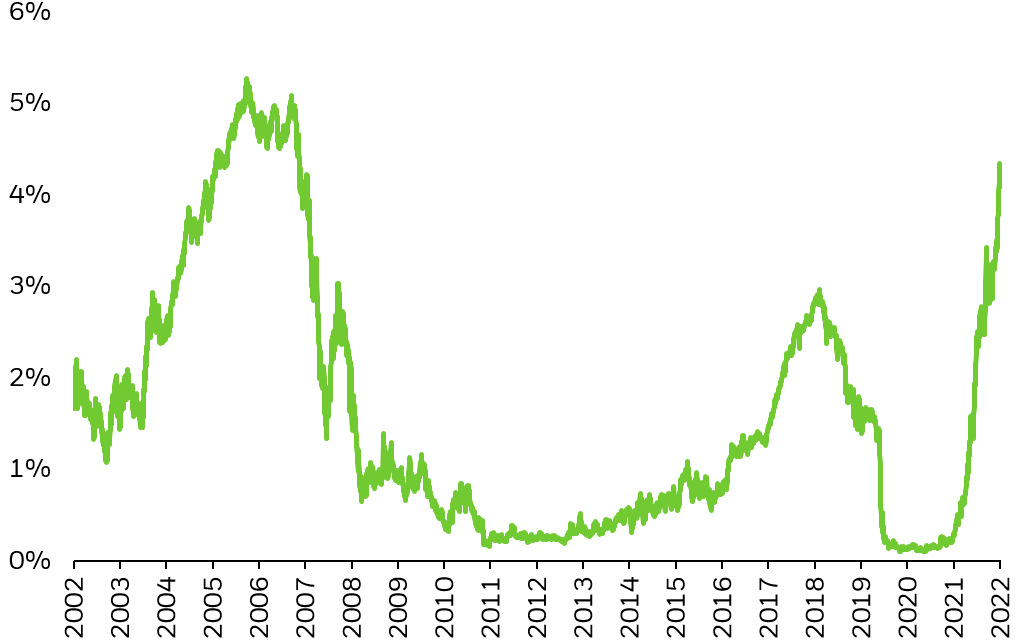

My thinking is that between now and the resumption of a long term upward trend in yields there will likely be a recession which will pull yields down and keep them. Additionally, these bonds come in a variety of forms, including treasuries. You can purchase new treasury bills at auction directly from the u.s.

Find out how to buy new or used. You can purchase new treasury bills at auction directly from the u.s. Treasurydirect account holders can participate in treasury auctionsheld on a regular schedule throughout the year.

There are two common ways to buy individual treasury securities: Learn how to buy treasury bonds, notes and bills from the government directly. Department of the treasury website for managing.

Government with no broker at treasurydirect.gov. If you buy a bond for less than face value on the secondary market (known as a market discount) and you either hold it until maturity or sell it at a profit, that gain will be subject. Backed by the u.s.

Treasury bills have maturities of four weeks to a.